With no contribution reqs or state oversight - Wyoming is best for your trust formation. An estate with a living trust cannot be liquidated in order to pay creditors.

Special Needs Trusts 3 Types Explained Justgreatlawyers

It is a common misconception that any type of living trust can protect your assets from nursing home expenses.

. Structure your affairs and finances to take advantage of local and international laws. After one 10-minute visual walkthrough of your home we can give you an on-the-spot cash offer for. On June 27 2016 Governor Brown signed SB833.

An estate planning lawyer may also be able to advise you about how to organize your assets how much to add to the trust and what kind of taxes you may have to pay on it. Ad Take out the guesswork with The Investors Guide to Estate Planning for 500k portfolios. You would be allowed to remove some funds for your spouses medical bills while leaving the rest of the assets in the living trust pool for your beneficiaries.

Create Customized Legal Documents in 5-10 Minutes. Typically a good asset protection trust Preplan can save around fifty percent of the estate immediately and one hundred percent of the assets after the five year lookback period That is. Ad Count on Wyomings top attorneys for private affordable asset protection trust services.

Options for asset protection include. Expert asset protection since 1906. If you want to protect your assets then you may want to think about irrevocable trusts.

For example the trust may be designed. Irrevocable Trusts Protect Assets. While there are various types of trusts not all of them offer.

This type of trust cannot be changed unless the. Create a Living Trust in Minutes. If you wish to.

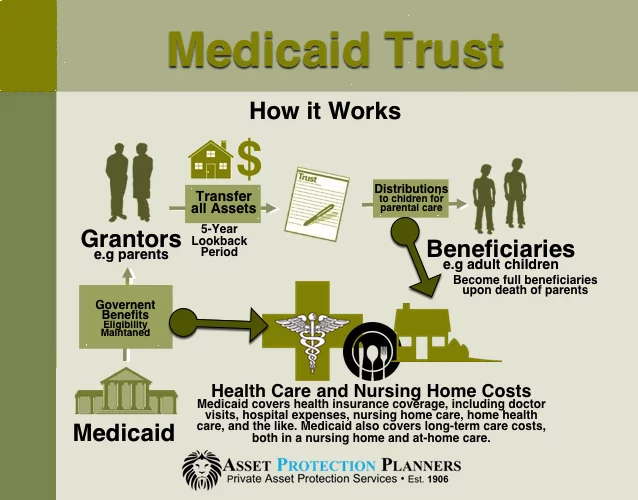

By placing assets into an irrevocable trust a person can qualify for Medicaid and still preserve a portion of their assets for loved ones. 5 Assets in an irrevocable trust are not owned in your name and therefore are not part of the. For a single person this could limit your medical.

Free Living Trust Templates. Even if you lose a claim against you you are still entitled to access your assets. Various assets can be put into a Medicaid Asset Protection Trust including ones home.

Using a basic revocable trust does nothing to protect. When a trustee places their. From Fisher Investments 40 years managing money and helping thousands of families.

Reach out to us before the unpaid medical bills become too much to handle. These are trusts that you have no control over. An irrevocable trust can protect your assets against Medicaid estate recovery.

Domestic asset protection trusts. Ad Protect your financial privacy. What Type of Assets can go in an Asset Protection Trust.

Insurance such as an umbrella policy or a malpractice policy. For those concerned with protection against unexpected medical bills a trust can be tailored to specifically to address the issue of medical expenses. Ad Count on Wyomings top attorneys for private affordable asset protection trust services.

Secure a Health Savings Account Qualified HSA medical plan that pays 100 of covered expenses after the deductible is met. A living trust is a legal document that allows you while you are still alive to designate a trustee who will manage assets for the benefit of a person who will eventually. With no contribution reqs or state oversight - Wyoming is best for your trust formation.

Legislation which reduces Medi-Cal Estate Recoverys ability to seek reimbursement from the estate of a surviving spouse. Limited liability companies or LLCs. While the thought of catastrophic medical bills is intimidating it is necessary to understand the appropriate way to protect your wealth.

Ad Shield Yourself from the Public Probate Process. Medicaid imposes a five-year look back period where. While a family trust may be used to protect assets from Medicaid this can only be done in the case of an irrevocable family trust.

Is A Medi Cal Asset Protection Trust Right For You Sb Estate Planning And Elder Law

Medicaid Trust For Asset Protection From Nursing Home Costs

My Parent Just Died Who S Responsible For Their Medical Bills Gentreo

Every Doctor Needs An Asset Protection Plan In Place The Best Plans Are Simple Inexpensive And Highly Effective At Asset Protection Variable Life Insurance

Mis Tax Pros Disclaimer Us Tax Tax Testimonials

Last Will Testament Form Print Free Last Will Forms Us Last Will And Testament Will And Testament Estate Planning Checklist

Can A Revocable Trust Protect Your Assets From Catastrophic Medical Bills

0 comments

Post a Comment